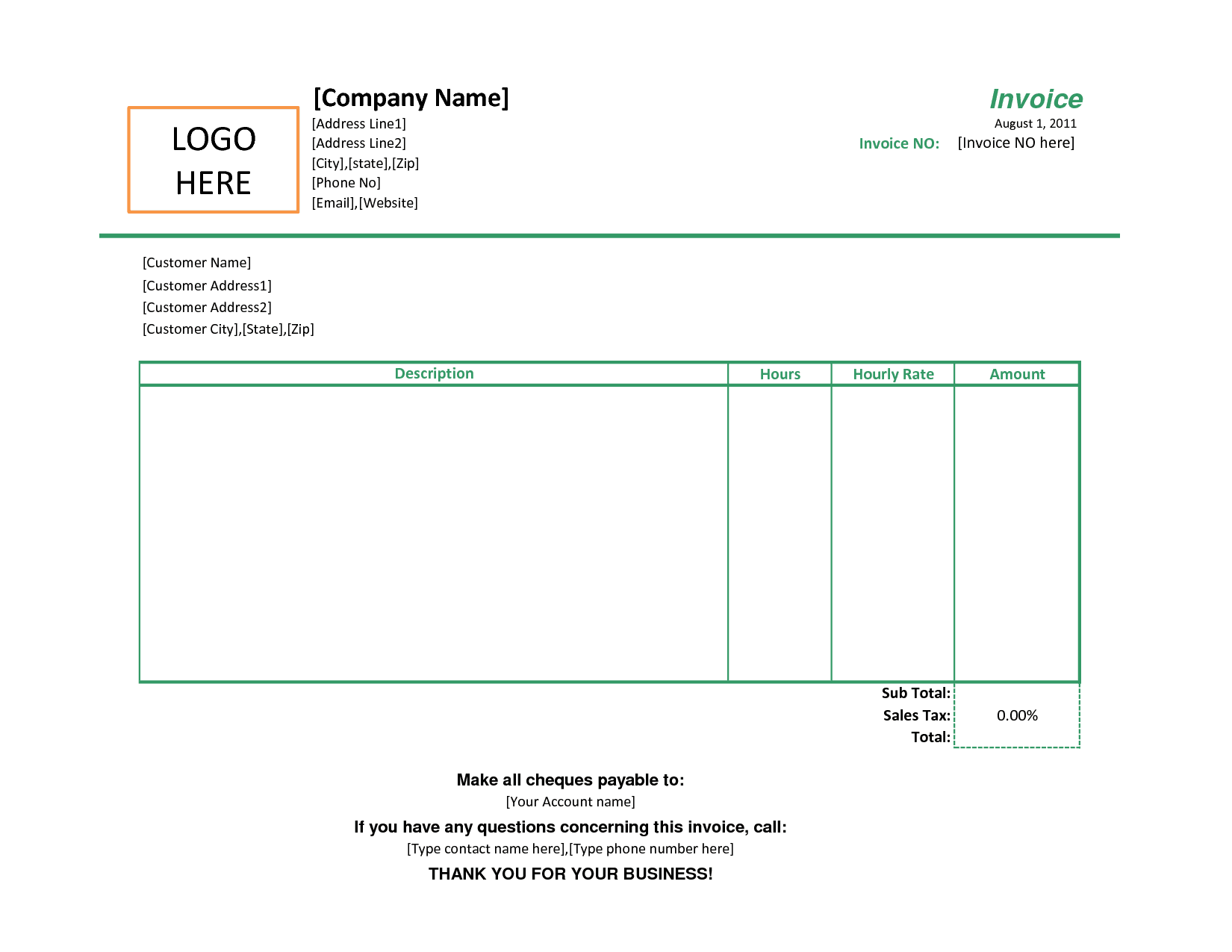

Identify the document with the word ‘invoice’ to differentiate from a quote, credit note or receipt. Sign up now What should be included in an invoice?Ī standard (non-VAT) invoice must include: Want to get the latest tips to boost your chances of getting paid on time? Sign up today to receive the Sage Advice newsletter, straight to your inbox.

#Invoices examples how to#

When is the best time to send your invoice?įinally, how to get paid on time, every time What a full or modified invoice must show Sole trader invoice vs limited company invoice

You can also use accounting software to create and send professional invoices, and track what is owed to you. To help you be professional, check out our article on invoice templates – we’ve designed a series of them, which you can download. Meanwhile, a well-formatted invoice can make the difference to ensure you get paid quickly avoiding complication from incomplete or unclear information.Ī well-designed invoice that covers all the required information will send a good impression to your clients and customers.Ī page with basic errors and unclear layout can make you appear unprofessional and is something that you will want to avoid.įor different business types such as sole trader, limited company and those registered for VAT there are specific legal requirements for what you must include in your invoice.īelow is a full guide to creating an invoice for your small business. One option is to use an automated solution that takes payments directly from your invoices so you get paid on time. Being paid what you are due is important but being paid on time is essential to avoid a strangled cash flow. Cash is the lifeblood of any business, without it you don’t survive.

0 kommentar(er)

0 kommentar(er)