At a time of high inflation and rising rates on all kinds of debt, vehicle buyers are facing monthly financing costs similar to the average mortgage payment 20 years ago. What’s changed is that these long-term loans are producing such high payments.

That’s not a historic high – seven-year car loans were popular before the pandemic as well. Karwel said special financing rates today typically come in around 3.9 per cent or 4.9 per cent and they’re often applied to the 84-month term.Īll of this explains why close to 60 per cent of buyers who finance are choosing a term of 84 months and up.

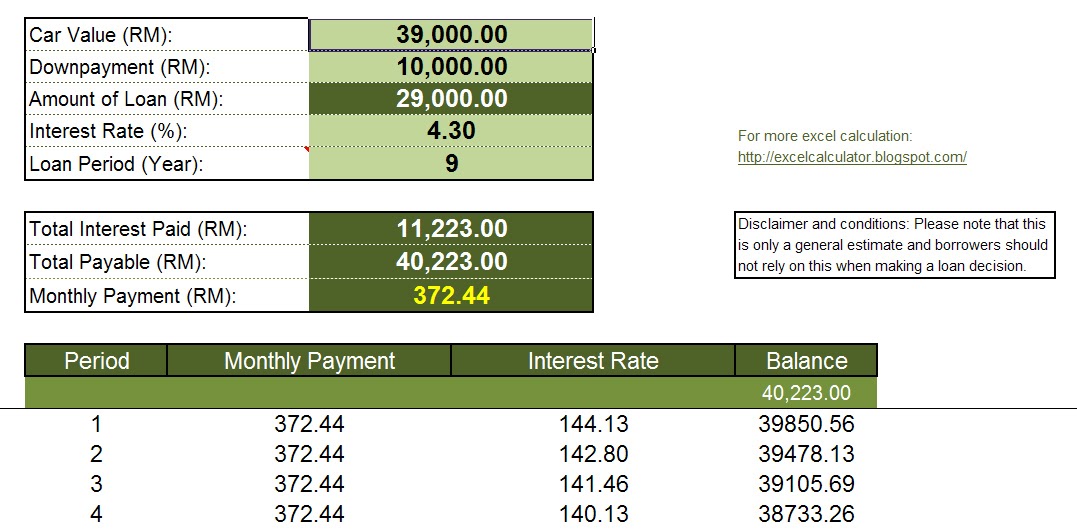

Car loan calc with trade in manual#

Power pegs the average new vehicle transaction price in July at close to $44,000, up from about $41,500 a year earlier.Īlso, 0-per-cent financing deals seem to have gone the way of manual transmissions. Production of vehicles was slowed by supply-chain issues, which has led to big price hikes and people being told in some cases that the car they want won’t be available until next year. Power’s used car data come from the used car departments at dealers selling new vehicles, which means the average age is two to five years.įew parts of the economy were hit harder by the pandemic than the auto industry. This explains why the average payment on an 84-month used car loan is so close to a new vehicle. Used vehicle prices have soared in the pandemic because of the weak supply of new cars and SUVs. Customers are going, ‘Geez, I can’t manage the payment on 72 months. “Used cars are accelerating in price faster. The dominant used car loan has now flipped from 72 to 84 months, said Robert Karwel, a senior manager at J.D. What’s new is that buyers of used cars are getting sucked in as well.

The popularity of long loans for new vehicle buyers has been on the rise for years.

0 kommentar(er)

0 kommentar(er)